Team Karen DeGasperis

DeGasperis & Assoc - Real Estate

Experience Living in Scenic San Diego

The California Home Insurance Crisis

A Looming Challenge for Homeowners and Renters

California is currently grappling with a severe home insurance crisis, with insurance companies reducing their presence or completely exiting the state.

With fewer options available, premiums have increased to an average of $2500-$4500. The highest policy I’ve heard is a staggering $43,000 in Jamul!

This crisis is causing significant challenges for both homeowners and renters. Homeowners are struggling to secure available insurance options, while tenants are at risk of facing higher rent increases. Additionally, the crisis is now spreading to the car insurance sector.

Today we will look into the reasons behind this insurance crisis and offer some tips to navigate the insurance market in California.

Why Are Insurance Companies Leaving California?

Several factors contribute to the why insurance companies are leaving the Golden State:

California Wildfires

California is susceptible to wildfires, with a growing and escalating risk.

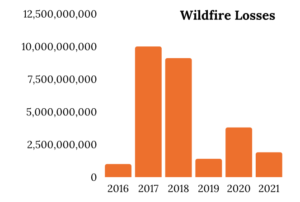

The devastating 2017 and 2018 wildfires wiped out decades worth of insurance reserves. California insurers disbursed more than double the premiums collected.

As a result, many insurers started dropping homeowners’ policies due to the wildfire risk, especially in high fire zones. Many homeowners had to switch to the California FAIR Plan which provides basic fire insurance coverage for high-risk properties when traditional insurance companies will not.

Regulatory Environment

With the devastating losses from 2017-2018, plus the COVID era losses, insurance companies have found themselves in the financial red in the state of California. While strict regulations aim to reduce costs, they often result in unintended consequences.

-Rate increases over 6.9% must be approved by the Insurance Commissioner. Unfortunately, the approval process can take several years, and in the meantime, costs and losses are increasing faster than insurance rates can support.

-Unrealistic rates calculations do not reflect the actual costs. Two key examples.

-Rate calculations must rely on historical data, not projected costs. (Example: your household budget could only use $4/gallon when gas is actually $6/gallon)

-Reinsurance is insurance for insurance companies. Rate calculations cannot include this cost for reinsurance.(Example: your household budget cannot include your insurance costs)

Rise in Goods and Services Costs

Inflation is driving up the costs of goods and services. Construction costs in California increased by 40%.

Supply chain challenges extend the time to build, which results increased costs. This includes expenses for temporary relocation housing and cost overruns.

Impact on Real Estate

This issue is concerning because homeowners are having a hard time finding adequate and affordable insurance to protect their homes.

Renters may face rent increases to cover the rising cost of insurance policies for both single family and apartment communities.

Rising insurance costs may lead to a downward pressure in home prices due to reduced purchasing power. As insurance costs go up, the financial flexibility to pay for higher prices goes down.

To Navigate the Insurance Crisis in California, Here Are Some Key Considerations:

–Insurance Renewals: Some insurers may require a larger down payment or payment in full, making it essential to review your insurance policies during renewal periods.

–When Buying a Home: When buying a new home, start looking for insurance early due to longer processing times, which average around 25 days. Lenders often demand insurance, and securing it is vital for loan approval. If you can’t secure coverage, your financing may not be approved.

-High-Risk Areas and the FAIR Plan: Be aware that the California FAIR plan covers fire losses but not comprehensive protection. You may need a supplementary “wraparound” policy for full protection.

-Legal Considerations: If you’re thinking about titling a home under an LLC, be aware that policies may be easier to find under a personal name rather than a business entity. Talk to your attorney and insurance agent to find the best option.

-Drive Safely: The insurance crisis is spreading to the auto insurance market, so maintaining a clean driving record is essential to avoid policy cancellations or significant rate increases.

What’s Next?

The Insurance Commissioner is exploring potential solutions, however, the legislative sessions have ended for 2023 so any further action is on hold until next year.

Despite the challenges, insurance brokers I have talked to believe that the crisis is not permanent. They believe that insurance companies will return to California when the regulatory environment improves. They may start with offering renters’ insurance and eventually make homeowners insurance policies available again.

Conclusion

The California insurance crisis affects both homeowners and renters. Be proactive and informed to effectively and successfully navigate the insurance crisis.

If you have questions or concerns, or need resources to find insurance to protect your home, let me know. I’m here to help!