Team Karen DeGasperis

DeGasperis & Assoc - Real Estate

Experience Living in Scenic San Diego

Is Now a Good Time to Buy a Home in San Diego?

If you’re considering buying a home in San Diego, you may be wondering if now is a good time.

As someone currently in the market to purchase a property in San Diego, I can confidently say “yes” and back it up with my own investment.

In this article, we’ll explore the reasons why now is a favorable time to buy, the benefits of purchasing a condo or townhome, a comparison of the San Diego and Atlanta markets, and key takeaways for prospective buyers.

Why Buy and What to Buy?

Our decision to buy in San Diego stems from a 1031 exchange of a rental property we own in Atlanta, Georgia. This exchange allows us to defer taxes when buying and selling investment properties. In terms of property type, we are opting for an attached condo or townhome instead of a single-family home.

Several factors contribute to this choice:

1. Reduced maintenance: Condos require less maintenance compared to houses, as the homeowner’s association (HOA) covers many upkeep responsibilities. Though HOA dues increase the monthly payment, they often prove more cost-effective than the maintenance and repairs associated with owning a house.

2. Lower turnover costs: Larger homes require more expenses to prepare them for sale or rent, whereas condos have lower turnover costs due to their smaller size.

3. Scarcity of condos in California: A law in California known as Latent Construction Defects (Civil Code 337.15) has significantly limited the construction of entry-level residential condos for sale. Consequently, most multi-family projects are developed as for-rent apartments, making condos a scarcity in the market.

4. Potential for increased appreciation: Due to their affordability and limited construction, attached homes like condos have, at times, outpaced the appreciation rates of single-family homes.

San Diego vs. Atlanta, GA Real Estate Markets

Many people consider purchasing homes outside of California due to the perceived greater value for money. As a licensed REALTOR in both California and Georgia, I will provide a brief comparison between the two markets.

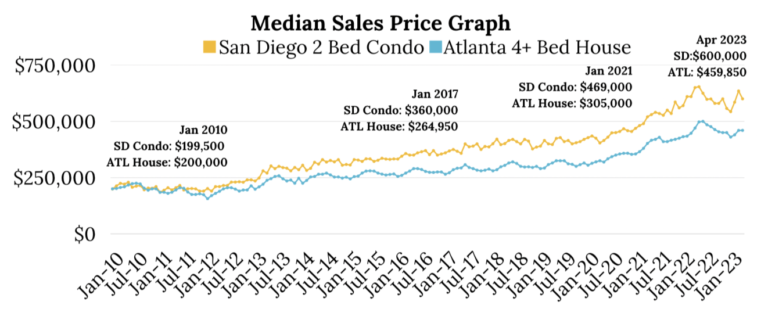

Average annual appreciation from Jan 2010 – April 2023:

-Atlanta 4-bedroom house: 9.99%

-San Diego 2-bedroom condo: 15.44%.

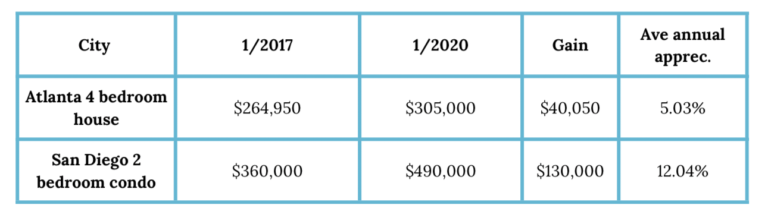

Since the last few years have been so crazy, let’s look at more “normal” years from Jan 2017 – Jan 2020. The gain in Atlanta is $40,000 compared to $130,000 in San Diego.

Conclusion: Two-bedroom condos in San Diego appreciate at a faster rate than single-family homes in Atlanta.

What could you buy today?

Based on today’s prices, suppose you are qualified for a $600,000 home. You could buy:

-2 Bed Condo in San Diego: $600,000 @ 12.04% appreciation

-4-bed House in Atlanta: $459,850 @ 5.03% appreciation

Over five years, the San Diego condo could appreciate to $1,059,295, while the Atlanta house may reach $766,864. This means that the San Diego condo could leave you nearly $300,000 better off. Which is a better investment?

Buying at the Market Peak (April 2022):

For those concerned about timing, let’s examine a scenario where a purchase was made in April 2022, near the height of the market, compared to April 2023:

In April 2022:

-Median priced condo: $660,000

-Average interest rate: 5.41%

-Monthly payment: $3,710

In April 2023:

-Median priced condo: $642,510

-Average interest rate: 6.59%

-Monthly payment: $4,099

Waiting a year for the lower price would have increased the monthly payment by $389.

Is Now a Good Time to Buy?

Considering the current market conditions, it is a good time to buy a home in San Diego. Here’s why:

-Interest rates: Interest rates are approximately 6.5%. If rates go up, monthly payments increase. If rates go down, more buyers enter the market, driving prices up. If rates remain stable, prices continue to rise.

-Rental market: If you’re renting, expect rent prices to keep rising.

-Locking in today’s prices: Buying now allows you to secure today’s prices before they continue to rise. It also allows you to lock in your monthly payment, safeguarding against potential interest rate or rent increases.

-Negotiating for better terms: When buying, you can negotiate for temporary interest rate buydowns and/or refinance in the future if interest rates decrease

Key Takeaways: In conclusion, the following are key takeaways for prospective buyers:

-Now is a good time to buy.

-Condos are a viable option and offer advantages over single-family homes.

-Don’t wait for interest rates to come down; you can negotiate for temporary rate buydowns and/or refinance later.

-Start with a starter home and use gained equity to upgrade.

-San Diego condos may appreciate faster than larger homes in other markets.

-Higher annual appreciation helps build net worth and generational wealth.

Real estate remains the cornerstone of the American Dream, and I am here to help you turn your real estate dreams into reality.