Team Karen DeGasperis

DeGasperis & Assoc - Real Estate

Experience Living in Scenic San Diego

San Diego Foreclosure and Short Sale Update - April 2023

San Diego Foreclosure and Short Sale Update

If you’ve seen recent headlines about foreclosures surging in the housing market, you’re certainly not alone. The stories in the media can be pretty confusing right now. They may even make you think twice about buying a home for fear that prices could crash.

The reality is, the data shows a foreclosure crisis is not where the market is headed, and understanding what that really means is critical if you want to know the truth about what’s happening today.

Here’s a deeper look.

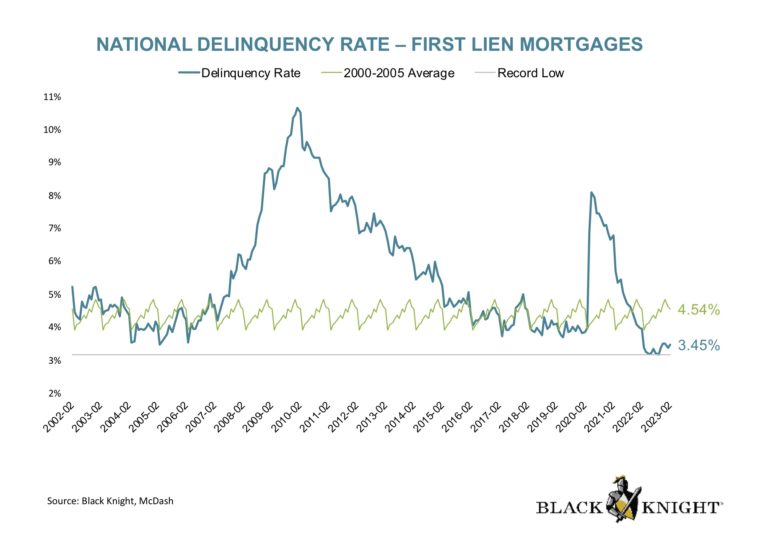

Figure 1: National Delinquency Rate – First Lien Mortgage

The headlines will show that foreclosure activity has increased, which is true.

However, look at it in perspective. Foreclosures were suppressed during the pandemic due to forbearance plans and moratoriums. This was not “normal” and now we are seeing it rise.

Delinquency Rate is Below Pre-Pandemic Levels.

The National Delinquency Rate is 3.45%.

-The percentage of mortgages that are in foreclosure is 0.46%

-California has one of the lowest delinquency rates of all the states. Our delinquency rate is 2.2%.

-The highest is in Alabama. Their delinquency rate is 7.3%.

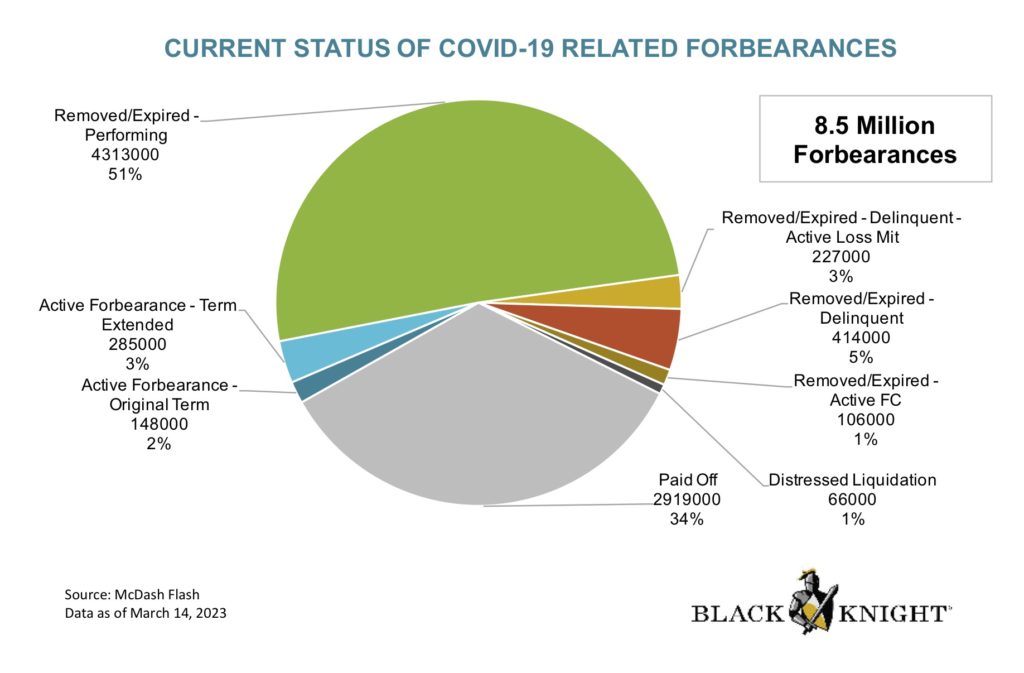

Figure 2: Current Status of COVID-19 Related Forbearances

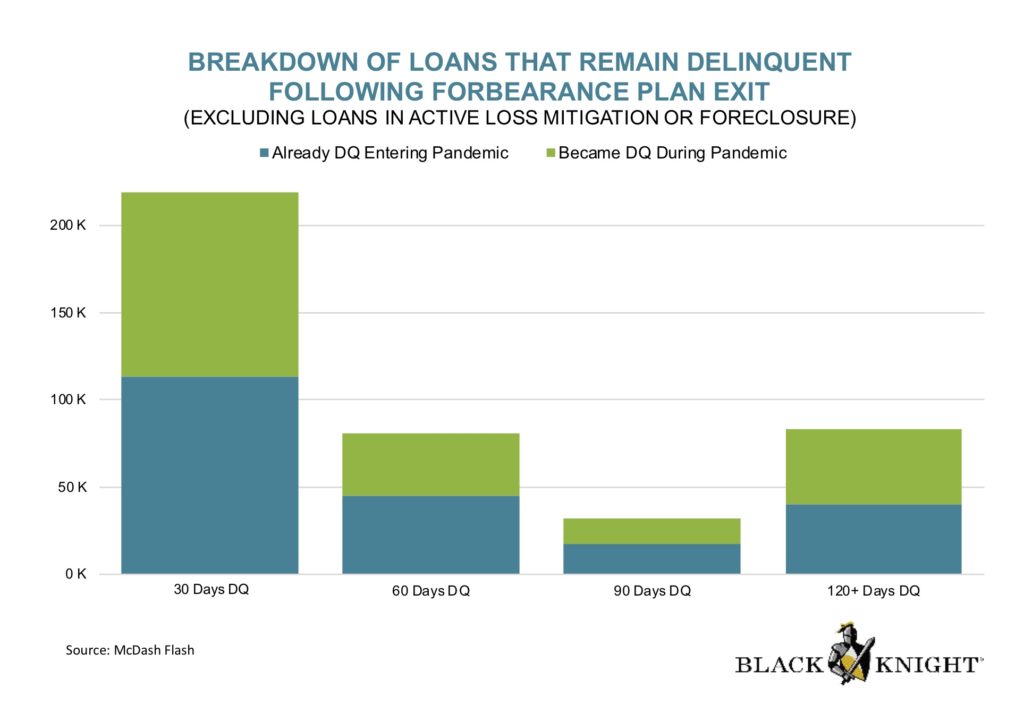

Figure 3: Breakdown of Loans that Remain Delinquent Following Forbearance Plan Exit

Ninety percent (90%) of mortgages leaving COVID-19 forbearance plans are performing or have been paid off. (Figure 2)

Of the loans leaving the forbearance plan that remain delinquent, about half of them were already delinquent BEFORE the pandemic!! (Figure 3)

San Diego Short Sales

Headlines have shown that some homeowners are upside down on their mortgages. This means that they owe more than the home is worth. Should we be worried?

Figure 4: Median Home Sales Price

Median Home Sales Prices

It is true that we have seen median sales prices decline since the peak in San Diego.

-May 2022 (peak): $855,000

-Dec 2022 (low): $749,000

-March 2023 (most recent): $800,000

Tappable Equity in San Diego is $470K

However, San Diego is one of the top 10 markets with the highest tappable equity at $470K. This is home equity homeowners could take out of their homes and still have 20% equity left over.

For those that purchased or refinanced within the last few years and put less than 13% down, they may have been upside down. But a short sale does not happen unless there is a sale of the property. If you are not in the market to sell, then it would not be an issue.

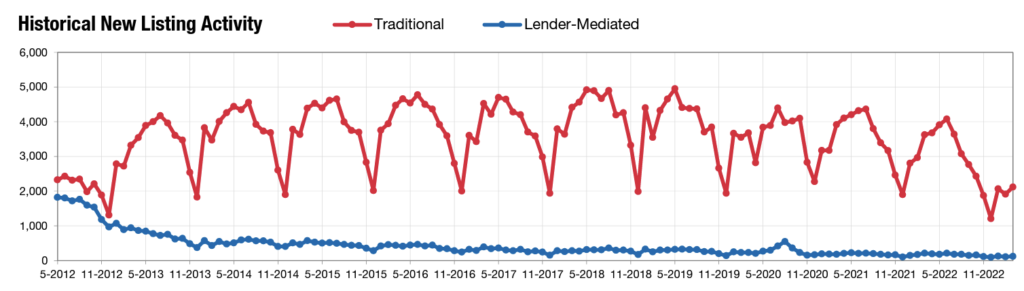

Figure 5 Lender-Mediated Properties Report (Source: SDMLS)

San Diego Lender Mediated Report

Inventory continues to be a crisis across the nation and in San Diego. Above is a chart which shows San Diego new listing activity compared to Lender Mediated Activity.

Even if/when foreclosures and short sales hit the market, the inventory is so low that they will be scooped up with minimal concern of prices dropping as a result. In fact, many of these are purchased by investors that are rehabbing and putting them back on the market for top price, which helps INCREASE the value of the homes.

Bottom Line

Foreclosures and short sales will increase but will not have a significant impact, especially here in San Diego.

Nationally, 96% of mortgages are performing and 90% of homes coming out of forbearance are performing or have been paid off.

If you are reading headlines and have questions or concerns about the real estate market, contact me! I love to talk about real estate.

Even if you’re not thinking about selling but want to know what your home is worth in today’s market, let me know, I’m here to help!!